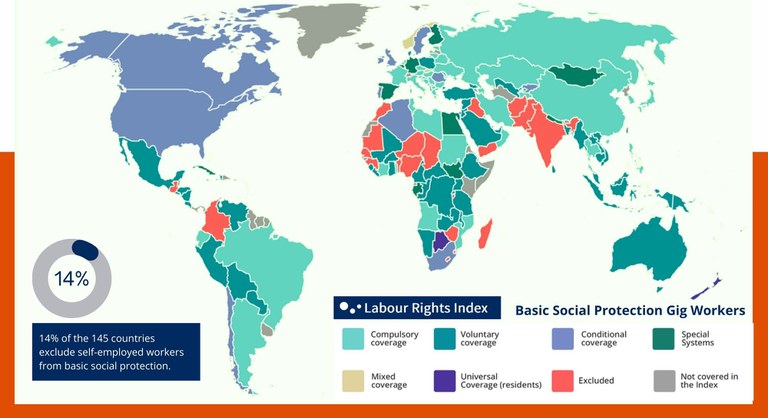

Out of 145 countries analysed, only 46 require compulsory social protection for the self-employed, while 21 exclude them. However, progress is being made with voluntary schemes introduced in Bangladesh, Qatar, and the UAE.

These insights come from the latest Labour Rights Index, a global benchmark by the WageIndicator Foundation and Centre for Labour Research, based on 15+ years of data.

One of the indicators, Fair Treatment, includes access to basic social protection for self-employed and gig workers.

LABOUR RIGHTS AT A GLANCE? CLICK HERE

This was also the focus of a project involving our new batch of Flame University interns.

After a general discussion on the topic ("Do countries with the most legislation always provide the right level of protection for gig workers? Do they need a contract to be treated fairly?), they delved into the realities of 8 countries using the Labour Rights Index, and breaking down labour rights by collecting information on legislation, employment contracts, and support.

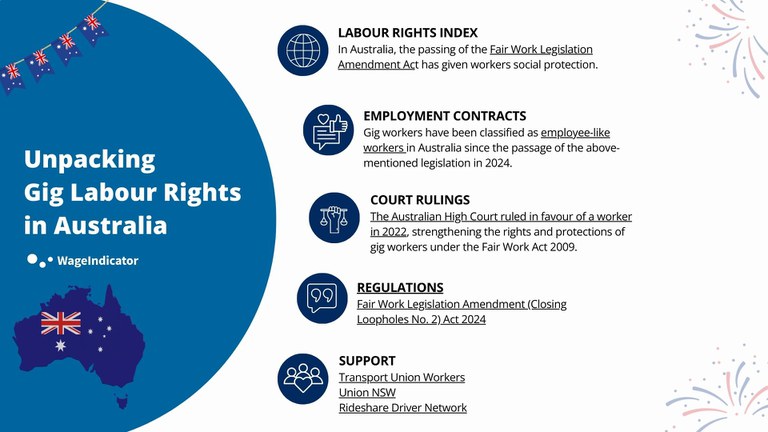

The Closing Loopholes Acts: a twist in defining the labour rights of Australian gig workers

The situation for gig workers in Australia has improved significantly since the passage of the Fair Work Legislation Amendment Act 2024. This legislation provides minimum rights and protections for gig workers who are 'employee-like' workers - and enables them to pursue matters before the Fair Work Commission and access support from the Fair Work Ombudsman in the same way as other workers. Minimum Standards Orders can include provisions on payment, deductions, certain record-keeping, insurance, consultation, representation, delegate rights, and cost recovery. Platform operators and trade unions representing the interests of employee-like workers will also be empowered to negotiate and conclude collective agreements in respect of certain employee-like workers. These collective agreements may, among other things, regulate the terms and conditions under which employee-like workers covered by the agreement will carry out their work on digital platforms. Under the new amendments, employee-like workers will be protected from "unfair deactivation" by the digital platform through which they perform their work if they meet certain criteria.

Bangladesh: A growing demand for fair wages and better working conditions

In Bangladesh, gig workers, particularly in sectors such as ridesharing, face significant challenges due to a lack of legal recognition and labour protections. Current laws classify gig workers as independent contractors, excluding them from employee benefits such as minimum wage, social security and workplace safety. This leaves gig workers vulnerable to exploitation and without legal recourse in the event of a dispute. According to a report, ridesharing drivers are calling for a legal framework to ensure fair wages and protect their working conditions. These demands reflect growing concerns about low wages and the lack of adequate safety measures for drivers, and highlight the urgent need for comprehensive labour rights protection in the gig economy.

Gig Workers in Canada: Facing Challenges of Misclassification and Striving for Better Protections

Gig workers in Canada face significant challenges due to their classification as independent contractors. This status denies them key benefits such as minimum wage, paid leave and employment insurance, leaving many with unstable incomes, unsafe working conditions, and little recourse for dispute resolution.

There have been recent efforts to improve their rights. Ontario's Employment Standards Act introduced measures such as mandatory rest periods and overtime pay, but most gig workers remain excluded because they are not recognised as employees. The Workers Compensation Act provides safety and compensation benefits for some, but coverage remains limited. The Digital Platform Workers' Rights Act, 2022, also in Ontario, addresses issues such as pay transparency, unpaid work and unlawful deactivation by platforms. However, its impact is hampered by the continued classification of gig workers as contractors.

The report, published in March 2023, highlighted that misclassification is at the heart of these challenges. It called for clearer definitions of employment and better protections under the Canada Labour Code. Advocates are also pushing for the adoption of the 'ABC' test, which presumes workers are employees unless their work clearly meets the criteria for independent contractors.

While there has been significant progress, including a Supreme Court decision in 2020 that allowed Uber drivers to pursue workers' rights, there is still much work to be done. Solving these systemic problems will require thoughtful policy and collaboration between federal and state agencies to ensure fairness, flexibility, and security for gig workers across the country.

Gig Workers in Ghana: Navigating Flexibility, Exploitation, and the Fight for Labour Rights

The conditions of gig workers in Ghana reveal a complex interplay of opportunities and challenges, particularly in relation to labour rights. Gig workers in sectors such as ride-hailing (e.g. Uber, Bolt) and delivery (e.g. Jumia, Glovo) enjoy flexible schedules and relatively accessible entry points into the labour market. However, they often operate without formal employment contracts, making them vulnerable to exploitation and lacking basic protections such as job security, social security and health benefits. Current labour regulations in Ghana have not been fully adapted to the gig economy, creating a grey area for the enforcement of labour rights. Gig workers are generally classified as independent contractors rather than employees, which excludes them from protections under traditional labour laws, such as minimum wage guarantees or compensation for unfair dismissal. While some platforms offer structured contracts for specific tasks or long-term engagements, most workers remain subject to inconsistent income streams and operational risks, such as vehicle maintenance and fuel costs in the ride-hailing sector.The ability of gig workers to organise for collective bargaining has been limited, partly due to the fragmented and transient nature of this workforce.

The Code on Social Security in India: Nice try, but implementation is key

Working conditions for gig workers in India are characterised by insecurity and limited protection, as they are classified as 'independent contractors' or 'partners' rather than employees. This classification excludes them from basic benefits such as minimum wages, paid leave and social security under traditional labour laws. The Social Security Code, 2020 recognises gig and platform workers as a distinct category and offers them access to health insurance, pensions and maternity benefits. However, its delayed implementation has left many workers without immediate relief. Court petitions, such as those against Ola and Uber, have highlighted demands for employee status and fair treatment, but no landmark ruling has yet comprehensively addressed these challenges. Gig workers often endure long hours, erratic earnings and safety risks, while advocacy groups such as the Indian Federation of App-based Transport Workers (IFAT) and the All India Gig Workers' Union (AIGWU) continue to push for better conditions. Despite some progress, systemic reforms and robust enforcement mechanisms are urgently needed to improve their labour rights.

Related Content: Women Marginalised in India

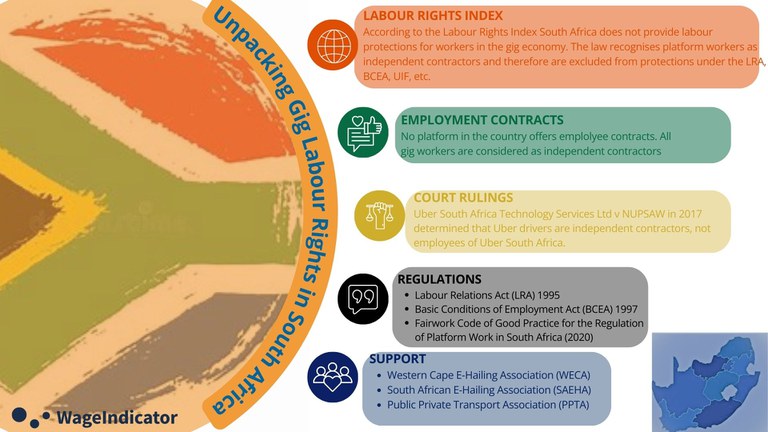

Slow progress and legal efforts: A dive into South Africa

In South Africa, gig workers are in a precarious situation because they are classified as independent contractors, which excludes them from many of the labour protections available to traditional employees. Existing labour laws such as the Labour Relations Act (LRA) and the Basic Conditions of Employment Act (BCEA) mainly apply to employees, leaving gig workers without key benefits such as minimum wage, paid leave, overtime pay or protection from unfair dismissal. This classification also prevents them from accessing social security programmes, including the Unemployment Insurance Fund (UIF). The failure to recognise gig workers as employees further limits their ability to organise or bargain collectively, increasing their vulnerability. Although advocacy groups and trade unions, such as the Western Cape E-Hailing Association (WECA), have been lobbying for change, progress has been slow. Legal efforts, such as those involving Uber drivers, seek to reclassify gig workers to provide them with basic rights and protections. Initiatives such as the Fairwork South Africa report highlight the need for regulatory frameworks specifically designed for platform work that promote fair wages, working conditions and protections for workers. Despite this, gig workers continue to exist in a legal grey area.

Related Content: Uber Eats Expands Beyond Food Delivery

UK: 1.7 million people waiting for basic protection

The conditions of gig workers in the UK are characterised by significant challenges to their employment rights. While the gig economy has grown rapidly, with around 1.7 million people engaged in gig work, many face precarious employment situations that lack basic protections. Gig workers are often classified as independent contractors, which limits their access to benefits such as minimum wage, holiday pay and sick leave. This classification creates a disparity between the rights afforded to traditional employees and those available to gig workers, leaving many vulnerable to exploitation and financial instability.

Recent legal developments, particularly the landmark Uber BV v Aslam ruling in February 2021, have begun to change this landscape by recognising certain gig workers as employees entitled to basic rights. However, many companies remain reluctant to classify their workers as employees due to the financial implications. A report by the University of Leeds highlights the urgent need for clearer definitions and protections for gig workers, and argues for a presumption of 'worker' status that would extend rights such as sick pay and pensions to over a million people in the UK.

The proposed Employment Rights Bill aims to address these issues by ensuring that gig economy workers have access to basic rights and protections, reflecting the growing recognition of their contribution and the need for fair treatment in the evolving labour market.

Significant but uneven progress for US gig workers

The conditions of gig workers in the United States reflect significant progress in terms of labour protections, but remain uneven in several respects. Gig workers, particularly in the ride-hailing and delivery sectors, are not restricted in their access to the same jobs as men and are conditionally covered by basic social protections. In the US, 56% of gig economy workers report juggling two or more jobs or projects, while 58% work 30 hours or less per week. In recent years, minimum wage floors have been introduced for ride-hailing drivers in 2020 and app-based delivery workers in 2022. In New York, app-based food delivery workers benefit from guaranteed minimum wages and additional benefits. On 9 January 2024, the US Department of Labor issued a rule requiring companies to classify certain gig workers as employees rather than independent contractors if they are deemed "economically dependent". This classification entitles gig workers at companies such as Uber and DoorDash to benefits such as social security, health insurance and paid leave. However, the gig workforce continues to face challenges, particularly when it comes to collective bargaining. The classification of gig workers as independent contractors, rather than employees of multiple companies, persists. As a result, worker groups such as Gig Workers Rising, Gig Workers United and the California Gig Workers Union are advocating for improved rights and seeking comprehensive solutions to ensure stable incomes and workplace protections for gig workers.

Related Content: US gig workers and the presidential election