For an Indian delivery rider, taxi driver, or remote online worker, it is becoming increasingly expensive to do their job.

WageIndicator's data on the cost of living for app-based workers in India shows how in 2024 the prices of essential items for this category of worker have generally increased compared to the previous year, with a notable impact on their earning capacity.

In this blog, we take a closer look at the work-related costs that have risen the most and analyse the short and long-term implications.

Indian gig workers: what are their conditions?

WageIndicator has recently studied the earnings and work-related costs of platform workers in India, as in other countries, both in the delivery and taxi sectors and in remote freelancing, to provide a deeper picture of the income insecurity they face in the short and long term.

While higher prices have an immediate impact on the earning capacity of these workers, in the long term it can affect their ability to afford healthcare or to save, invest, and retire, as these additional costs fall entirely on their shoulders. This is an often overlooked consequence of the cost of living crisis affecting platform workers and freelancers around the world, which is highlighted by the quarterly WageIndicator data collection.

What are the costs for app-based workers in India that have increased the most?

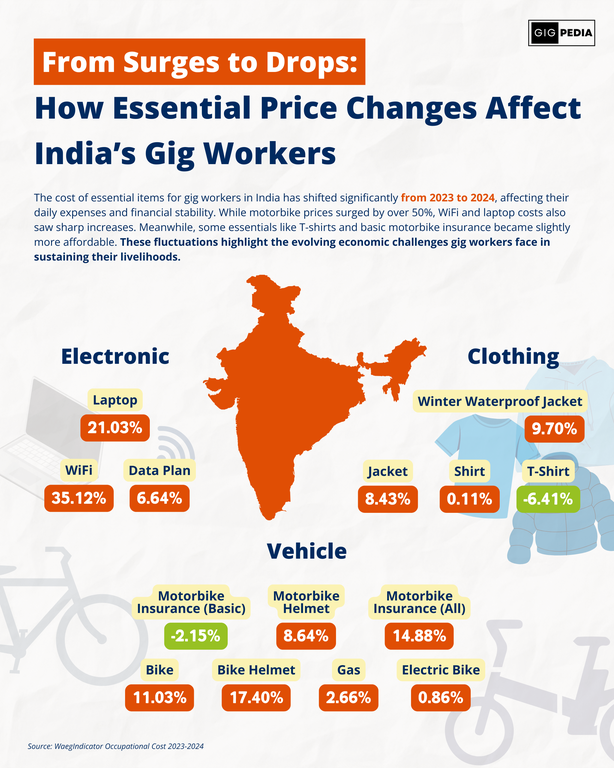

Examples of increases in daily costs faced by platform workers in India in 2024 compared to the previous year include equipment, electronics, and clothing.

- Equipment such as motorcycle helmets, which are +17.40% more expensive, bicycles, +11.03%, and motorcycle helmets, +8.64%.

- There has also been a general increase in the price of electronics: data plans are up +6.4%, and price hikes are also affecting remote workers. Wifi plans have seen the largest price increase, +35% in 2024 compared to the previous year, while laptops are 21.03% more expensive.

- Clothing is not exempt: according to WageIndicator's data collection, buying a winter jacket or a jacket has become more expensive by 9.70% and 8.43% respectively.

Do platform workers in India earn more than the national minimum wage?

As mentioned above, rising prices need to be seen in a broader context, where the lack of wage protection, lack of social security and peculiar social organisation also play a role.

The typical worker in both the delivery and taxi sectors works long hours for low pay, earning less than the national minimum wage. Recent protests have highlighted the same issue for domestic workers, who are expected to meet unrealistic performance standards and work overtime without additional incentives.

Despite the existence of regulations such as the Minimum Wage Act, 1948 and the Code of Wages, 2019, which provide basic working conditions, gig workers don't enjoy any rights.

On the platform side, only Bigbasket and Urban Company have demonstrated that gig workers are paid at least the local minimum wage after costs.

To lead the debate on this issue, some local initiatives, limited in scope, have made headlines: the Jharkhand government has set up an advisory committee to discuss the possibility of including gig workers in the scope of unskilled labour and applying this minimum wage to them, and the All India Gig Workers' Union (AIGWU) has stressed the importance of enforcing 'effective minimum wages' per month and using them to 'determine the minimum wage for one hour of work on a platform'.

However, despite the year-long discussion and local efforts to address this issue, there is still a need to reform current labour laws to protect the rights of gig workers in terms of pay.

Why does the cost of living have a social dimension?

The cost of living for platform workers in India has a social dimension, as it affects workers but also their families: many platform workers are motivated to work in the gig economy to support their loved ones, and platform work is a primary source of income, not just a sideline.

In 2022, not-so-recent research has already highlighted that many gig workers are living hand-to-mouth financially, with a significant proportion of their income focused on essentials and work equipment. Daily expenses that prevent them from affording health care or having a safety net for savings or investments, with long-term consequences that reinforce social and economic divides.

Where can Indian gig workers start to tackle the cost of living crisis?

While the Indian government's recent budget announced social security benefits, including healthcare, for some 10 million gig workers, more data and insight is needed to assess the impact of the cost of living on the financial resilience of these workers, who not only need to cover day-to-day expenses, but also to withstand and recover from financial shocks or unexpected events. And this is where WageIndicator comes in, with plans to go deeper to shed light on this pressing issue.

To better understand the challenges that gig workers face in negotiating fair compensation based on their cost of living, WageIndicator has developed the Living Tariff concept.

It's a response to the need for workers who face economic insecurity and are paid less than the minimum wage to determine what is sufficient for them to live a decent life with their family in their place and time.

As the daily amount that a self-employed or gig worker needs to earn a Living Wage, the Living Tariff allows for a more focused conversation about pay for gig workers and freelancers because it takes into account their specific circumstances, especially the known but also hidden work-related costs (think of unpaid activities like travelling between jobs or looking for gigs) that an employee doesn't have.

Daniela Ceccon, WageIndicator Data Director explains it well: “The Living Tariff opens the door to an important discussion: the work-related costs faced by gig workers and freelancers. This aspect is often overlooked when people talk about the platform economy and freelance work. While comparisons are often made between what these workers earn and what employees earn, failing to account for all the additional costs leads to a misleading conclusion.”

| If you are a platform worker or freelancer based in India, use the Living Tariff tool to calculate fair compensation based on your specific situation. |

📌Find out everything you need to know about the Living Tariff

🗺️Learn how the cost of living is affecting platform workers around the world, from Brazil to Vietnam.