With the rise of the gig economy, app-based workers should be able to rely on a decent income. But how much should a gig worker earn to live a decent life?

This is the key question explored by WageIndicator's Living Tariff, which was the focus of an informative online session led by Paulien Osse, Head of the Living Wage team, and Daniela Ceccon, Data Director.

The discussion with the audience revolved around calculating a fair income for gig workers and freelancers, and how such a tool could also be used to raise awareness of work-related costs and unpaid work.

What is a Living Tariff for workers in the gig economy?

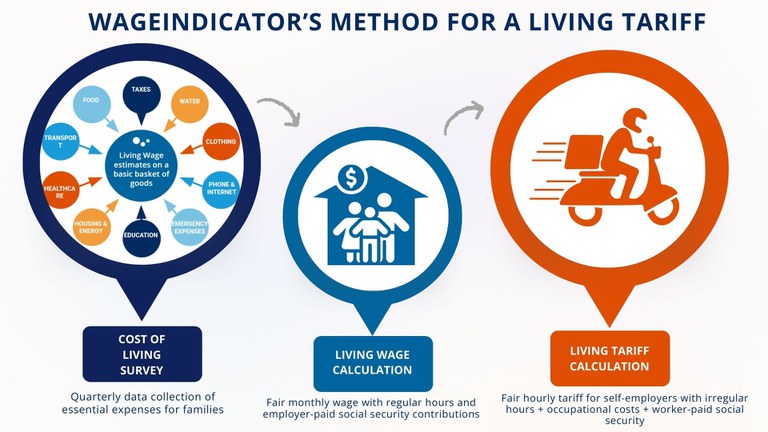

The Living Tariff as a concept is the daily amount a self-employed or gig worker needs to earn to achieve a Living Wage. It includes:

- basic living expenses (WageIndicator’s Living Wage)

- work-related items (equipment)

- overhead time

- income taxes

- social security

- savings for illness or retirement.

The sum of the six components above is the minimum Living Tariff. By taking these additional costs into account, the Living Tariff helps to ensure that a worker's income is sufficient to cover all essential work-related expenses.

The Living Tariff is derived from the methodology that WageIndicator has been working on for ten years to calculate Living Wages for employees. But when it comes to app-based workers or freelancers, things change. When it comes to app-based workers, it becomes difficult to accurately assess what they should earn due to hidden work-related costs (e.g. long waits for taxi drivers, last-minute cancellations, etc.) and a lack of knowledge and awareness.

"In a global context where platform-based work is generating income for millions of people, the Living Tariff is a new concept based on the idea that while the self-employed are seen as entrepreneurs, it makes sense to have a floor so that people who don't have a boss don't have to die to make a decent living," says Paulien Osse at the info session.

What's the difference between Living Wage and Living Tariff?

A Living Wage is paid when a worker receives remuneration that is sufficient to afford a decent standard of living for the worker and her or his family in their place and time. But Living Wages only apply to employees; when platform workers and freelancers are involved, a new approach is needed, and this is where the Living Tariff comes in.

WageIndicator has been calculating Living Wages for ten years, and the methodology is based on the assumption that the worker has a normal working week. No overtime, no extra jobs.

This means that, as explained by Daniela Ceccon at the info session, "Living Wages only apply to employees with a normal contract and normal working hours who work for an employer who pays the mandatory social security contributions. If working hours vary, and workers have to pay for tools and extra waiting time, this model is no longer valid."

How is the Living Tariff for gig workers calculated?

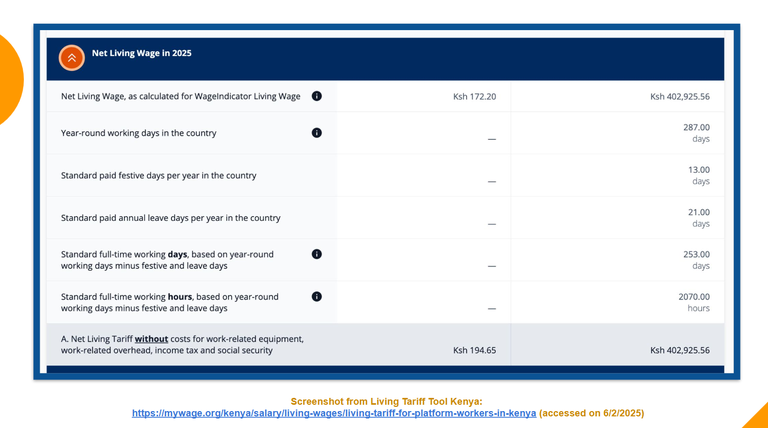

"In terms of calculations, we first calculate the Living Wage and from that we calculate the Living Tariff," explains Daniela Ceccon. "To the Living Wage we add the social security contributions, which are normally paid by the employer, but in this case they are paid by the worker".

The Living Tariff is always calculated on an hourly basis, as different gig workers work different numbers of hours.

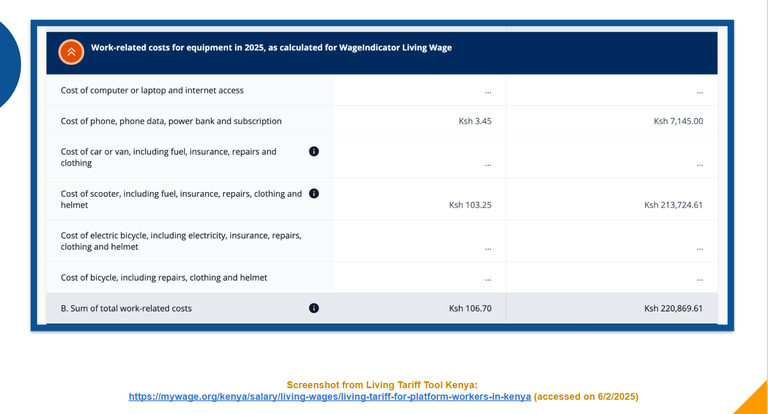

One of the factors taking the biggest toll on gig workers is work-related items, which includes the equipment that gig workers have to pay for themselves to do their jobs. “That's why we ask the worker what platform they're working on and what job they're doing.” On this basis, the worker is asked to fill in their professional expenses (telephone, laptop, car, motorbike, maintenance, clothing, etc.).

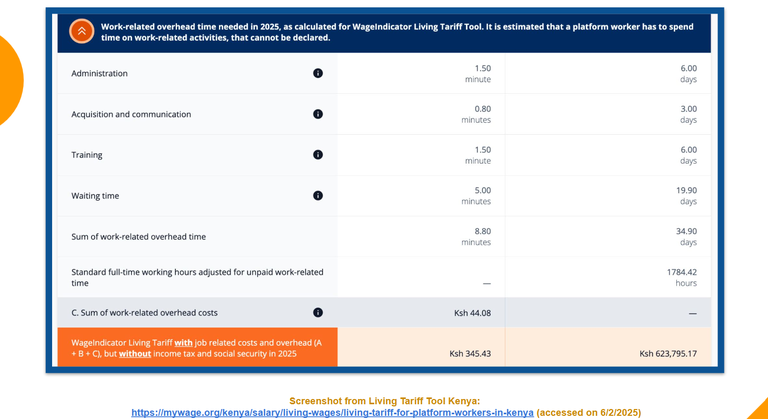

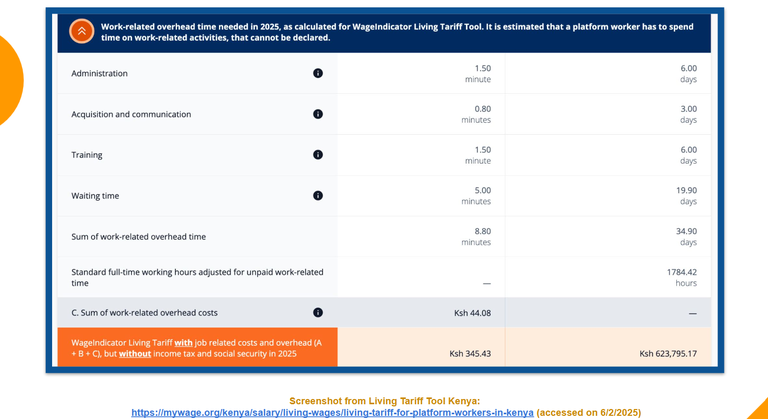

In the gig economy, unpaid work is a multifaceted phenomenon that is not just about equipment, but also about overhead time, and this factor needs to be taken into account. As analysed in the recent WageIndicator webinar, No Such Thing as a Free Coffee, it is crucial to assess the cost of unpaid work in the gig economy in terms of time, as there are many unpaid activities that gig workers are involved in that need to be included in the calculation (apart from waiting time, administrative tasks, training, communicating with clients, etc.). The Living Tariff does this.

Finally, the Living Tariff allows to add income taxes, reservation for pension, disability, sickness, and medical insurance. “In this way, we achieve a Living Tariff that allows the worker to cover the main expenses associated with their job and the cost of living. And the worker can adjust it if they feel that the figures don't fit".”

How can the Living Tariff help gig workers apart from the cost calculation?

The way it has been designed and developed, the Living Tariff can also be a tool for raising awareness.

“People often ask how we can ensure that platform workers, who are so vulnerable, receive a living wage," Paulien Osse points out. "I believe change is possible. Researchers can contribute, but clients also have a role to play. It’s about raising awareness. We have had a lot of discussions with large companies about their self-employed workers —who they hire and how they can make this work. We're seeing a growing interest from organizations reaching out to talk about the Living Tariff. Let’s continue the conversation and spread the word."

Daniela Ceccon adds: "The Living Tariff makes it possible to launch another important debate: that on the work-related costs of gig workers and freelancers. This is something that is not very clear to people when they talk about the platform economy and freelance work. Maybe they look at what these workers earn compared to what employees earn; but if you don't look at all these additional costs, the conclusion is misleading.

It's also helpful for the workers: “There are many cases where gig workers don't think about having health or safety insurance, but then accidents happen.”

Check out the full calendar of WageIndicator's Living Wage Info Sessions and make sure you don't miss any of the upcoming events.

🔎See here how the Living tariff is calculated

🚀Dive into the Living Tariff in our blog Towards a Living Tariff: Even freelancers deserve a fair income

💻Ready to see it in action? Test the Living Tariff Tool yourself